Movies |

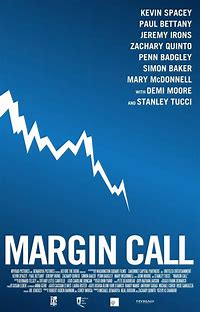

Margin Call

By

Published: Mar 18, 2023

Category:

Drama

“Margin Call” was conceived in the throes of the 2008-2009 Wall Street crisis. Firms like Lehman had been coining fortunes packaging subprime mortgages. Individually, many of them were handed out like candy on Halloween to people who couldn’t really afford them. They were also bundled and marked as better than they really were and sold to institutions. When the music stopped, who cared about Lehman? Not anyone on Wall Street. Not anyone in government. The largest bankruptcy in American history followed, involving $600 billion in assets and causing the biggest one-day drop in the stock market since 9/11.

What if a company like Lehman saw it coming? Not coming weeks or months away, but that day. Imagine that the CEO calls an emergency meeting at 4 AM. What can the company do to save itself?

The first thing to understand: this firm no longer has “clients,” it has “counter-parties.” And the counter-parties are on their own. Caveat emptor. As the poster for this movie has it: “Something big is going down.” And what’s going down is this venerable Wall Street firm. You’re good in math? You invest and do okay? Well, you may not grasp what’s going on here. But better than any documentary, this fictional story shows you what can happen and what it looks like.

The problem here is these crappy, bundled mortgages can’t be deodorized and polished. They’re not worth much, and today there will be a reckoning. There’s a tough decision to make. Well, really not — the firm must sell this worthless crap to clueless buyers. If it doesn’t…The CEO is Jeremy Irons, and he’s slicker than snail snot. And tougher. “There are three ways to make money,” he says. “Be first. Be smarter. Or cheat.” But this moment requires a fourth way: a fire sale. No one in film has ever said “so .. we .. may… survive” better. Watch the emergency meeting.

The all-star cast — Kevin Spacey, Jeremy Irons, Stanley Tucci, Simon Baker and Demi Moore — gives impressive performances. Especially Irons. This is great dialogue:

So you think we might have put a few people out of business today. That it’s all for naught. You’ve been doing that every day for almost forty years, Sam. And if this is all for naught, then so is everything out there. It’s just money; it’s made up. Pieces of paper with pictures on it so we don’t have to kill each other just to get something to eat. It’s not wrong. And it’s certainly no different today than it’s ever been. 1637, 1797, 1819, ‘37,’ 57, ‘84, 1901, ‘07, ‘29, 1937, 1974, 1987— and whatever we want to call this. It’s all just the same thing over and over; we can’t help ourselves. And you and I can’t control it, or stop it, or even slow it. Or even ever-so-slightly alter it. We just react. And we make a lot of money if we get it right. And we get left by the side of the road if we get it wrong. And there have always been and there always will be the same percentage of winners and losers. Happy foxes and sad sacks. Fat cats and starving dogs in this world. Yeah, there may be more of us today than there’s ever been. But the percentages — they stay exactly the same.

To varying degrees, thee executives care. But they care more about themselves and their bounds and their kids’ school fees. . Watch the trading floor that morning.

This is a film for grown-ups (and their smarter kids). For viewers who don’t need white hats and black hats, unsullied saints or satanic sinners. So gather the clan, microwave some popcorn and watch closely. And then ask yourself: What would I do if I were Jeremy Irons? Or, more immediately, what should you be doing about your investments this week? {To rent the video stream from Amazon Prime, click here.]